- Careers

- Investment Center

- Retail Partner

- Online Services

- (833) 689-LOAN

- Apply Now

Life throws us curveballs all the time. At one point, bad luck, poor choices or unfortunate circumstances may have landed your credit score on the lower end of the scale. While there are several credit scoring systems, the most popular is the FICO score which is used by the big three credit reporting agencies (Equifax, Experian and TransUnion). The FICO score ranges from 300 to 850, which is a perfect score.

The definition of a bad credit score will depend on the lender and the type of credit you’re seeking. For example, many home mortgage lenders consider anything below 620 as sub-prime while other lenders can consider 640 or 680 sub-prime. Sub-prime is defined as borrowers with tarnished or limited credit history who present more risk to lenders.

The impacts of bad credit extend far beyond what many people think of as the traditional consequences such as the inability to be approved for a credit card or purchase a home or car. Consumers with bad credit often find it difficult to:

Why the connection to employment? A survey by the Society for Human Resource Management found that six out of ten private employers check the credit histories of at least some of their job applicants, and 13 percent conduct them on all candidates to help prevent theft and get a sense of dependability of a candidate, among other reasons.

Borrowing even small amounts of money can present challenges since people with bad credit face limited options. Traditionally, banks have been the first choice for personal loans. However, if bad credit is an issue, the chances of approval are slim. Even without bad credit, securing loans for small dollar amounts is unlikely to happen since most banks won’t approve loans under $5,000 due to the lack of revenue generated by these small amounts.

So where does this leave consumers with borrowing needs of less than $5,000 who also have bad credit?

Installment loans are becoming an increasingly popular solution especially for those with bad credit. Installment loans help people with unexpected expenses or various life needs, such as:

Simply, an installment loan allows you to borrow once and then repay with regular, fixed payments (usually monthly payments that don’t increase or decrease) over a previously defined period of time. With good or bad credit, installment loans provide a fixed interest rate and a set monthly payment that is based on the loan balance, interest rate and time you have to repay the loan. This means that with each payment you make, you reduce your original loan amount while also paying interest costs. Home mortgages and auto loans are two common types of installment loans.

There is a difference in installment loans and payday loans. Unlike payday loans installment loans offer larger amounts of money and are also:

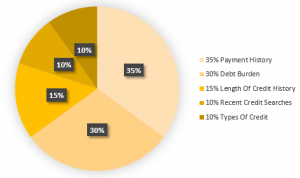

It is also notable that installment loans can be good for bad credit. Your FICO credit score is based on various factors of financial history:

In the heavily scrutinized financial market of today, it’s easy to find supporters and critics of installments loans. For bad-credit ridden consumers, advocates say installment loans are a better option since, unlike payday loans, there is no final balloon payment that can cause the borrower to incur even more debt. Also, since installment loans can actually improve credit scores, they automatically gain better standing in the eyes of many financial professionals and consumer advocates.

However, there are also plenty of critics of installment loans and the companies that offer them. Unfortunately, predatory lending isn’t new to the financial industry, which is one more reason borrowers must carefully evaluate and select the lending institutions they choose to work with.

With 279 loan offices in 6 states in the southeast, 1ˢᵗ Franklin Financial is a leading provider of installment loans for bad credit borrowers. Unlike the faceless online lending institutions, 1ˢᵗ Franklin Financial has a history of being active in the communities we serve (primarily rural areas), which allows us to know and help generations of families. In fact, since 1941 our goal has remained this: to serve the financial needs of our friends and neighbors with the respect and personal service they deserve. Respect says a lot, and it’s what has driven the creation of our installment loan programs.

A few of the differences you’ll notice with an installment loan from 1ˢᵗ Franklin Financial are:

While bad credit can make your financial life more difficult, 1ˢᵗ Franklin Financial makes the process of getting approved for an installment loan easy. Whether your have unexpected expenses or need a little extra help giving your family the Christmas you want them to have, we can help. When you’re ready to get started simply complete our online form and a local representative will contact you.